Law firms must brace themselves for big increases in indemnity premiums. Eduardo Reyes takes the pulse of a rapidly hardening market

The professional indemnity insurance market was hardening even before Covid-19 hit. Claims against all professionals were increasing and Brexit-related uncertainty is an unquantifiable risk – insurers’ least favourite kind.

The result will be greater expense for law firms. ‘Firms should brace themselves for an average increase of 30%,’ Law Society president Simon Davis says. ‘But those with bad claims histories should expect far higher increases.’

Once the mandatory renewal date for all law firms, many have moved away from 1 October – preferring policies that run for more than 12 months, aligning with the financial year. That has taken some pressure off the traditional deadline, but it remains the most significant renewal date.

‘Around 70% of our clients will renew on 1 October, which is similar to the same period last year,’ Patrick Bullen-Smith of broker Hera tells the Gazette. Ed Pickard, head of UK professions at brokers Miller Insurance, puts the figure at 60%. Lockton partner Brian Boehmer says: ‘We have renewals every month of the year but between August and November 61% of our total clients renew, with 52.8% of clients renewing on 1 October.’

October renewals worse than April

‘We renewed at the end of April and were very lucky to receive an 8% increase in premium because we had signed up to a second-year commitment deal with insurers,’ notes Rebecca Atkinson, director of risk and compliance at London firm Howard Kennedy. ‘We were informed by brokers at the time that premiums were increasing 50%-plus for some firms and we were in a unique position.’

The Law Society expects almost all firms to see premiums increase in October, particularly if coming out of an 18- or 24-month policy.

Regulator 'ignored' insurers

‘Most of the remaining participating insurers wrote to the Solicitors Regulation Authority requesting a change to the punitive minimum terms and conditions,’ Miller Insurance’s Ed Pickard relates. Of particular importance to insurers is the non-cancellation provision for non-payment of premium, which allied with the six-year run-off provision could expose insurers to seven years of risk with no premium paid.

‘The SRA ignored these requests,’ Pickard notes. As a consequence, he believes ‘law firms will find an evener harder market, with few, if any, insurers looking to underwrite new risks, not least because the SRA does not seem amenable to change. With this will come a contraction in capacity’.

Lockton’s Brian Boehmer concurs: ‘The SRA’s unwillingness to listen to the insurers and implement some change in respect of run-off coverage not being available should a practice fail to pay is farcical. Insurers are not necessarily against providing run-off coverage but they absolutely wish to get paid for accepting the transfer of risk. This point goes completely against the basic principle of English contract law, as without consideration (payment) you should be able to question its validity.’

The SRA says the requested reforms do not protect consumers. A spokesperson stated: ‘Everyone will be aware that we have recently undertaken a comprehensive, two-year period of consultation on insurance issues, including looking at a fundamental review of our minimum terms and conditions. Late last year, our board decided that in the light of feedback from the profession and consumers, the risk to client protection meant there would be no changes to the cancellation of run-off cover due to the non-payment of premiums.’

The topic is not closed for the regulator, but the spokesperson adds: ‘It will be some time before the implications of the Covid-19 pandemic are fully understood but we, like everyone else, are monitoring closely. To revisit this particular issue we would need a strong evidence base that a new problem was emerging and that consumers could be effectively protected in some other way. We have been talking with the insurers and are working with them to mitigate the risk of non-payment of premiums while maintaining this important consumer protection. We will continue those discussions over the next few months.’

Capacity concern

Miller’s Pickard puts it starkly. In recent years ‘capacity has shrunk’, he notes. ‘A number of insurers have left the market, and a number of the key participating insurers will only write “renewals” and not quote new business.’ Pickard observes ‘an escalation of the market conditions experienced in 2019 and for 1 April renewals’, adding: ‘While insurers have not exited the market in 2020, what we have seen across all professions is insurers looking to reduce capacity deployed on renewals while at the same time having minimal appetite for new business.’

The legal sector is not unique. Hera’s Bullen-Smith points to ‘a worsening claims situation across all professional indemnity sectors, not just solicitors’.

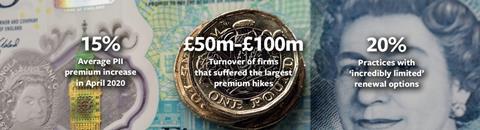

Lockton’s Boehmer is equally blunt: ‘There is still active capacity competing for business but unfortunately this is only for approximately 50% of practices. For a further 30% of practices there are options, but these are more limited with up to three alternatives. Sadly for the remaining 20% of practices this is not the situation; they will have incredibly limited alternative options likely to be available for them this year, and in the absolutely worst-case scenario no option at all, not even from their incumbent insurers.’

Bigger may not be cheaper

The Law Society cites research by Lockton on the experience of firms renewing in April 2020. This revealed that larger firms faced some of the biggest increases in premiums – while premiums increased by an average of 15%, firms with turnovers of £50m to £100m saw increases of around 40%.

Boehmer says: ‘The alternative insurers that some practices have used as a stalking horse annually in order to get their price down may not be available or as willing this year to provide this service.’

Extra cover hike

‘The cost of additional-layer insurances has continued the trend from the spring, with rates and premiums rising steeply,’ Boehmer says. ‘Often these are greater increases than the rate rises being applied by the compulsory primary insurers.’

Covid questions

The Law Society’s Davis says: ‘Covid-19, the uncertainty of Brexit negotiations and the fact the market was hardening already in 2019 all combine to mean that October 2020 could be the most challenging period for solicitors since the insurance market opened up in 2000.’

Covid-specific information is being sought, he adds: ‘There will also be additional questions about how the lockdown and Covid-19 have affected business, including redundancy plans, furlough scheme use, home-worker supervision and the steps that have been taken to minimise risk.’

‘Covid-19 has certainly changed the way insurers are viewing “risk”,’ Bullen-Smith relates. ‘Every insurer requires the completion of a Covid-19 questionnaire. This is a detailed document which gives insurers an overview of the processes a firm has in place to supervise employees working from home; meeting government guidelines when returning to the office; client service levels; financial viability through the pandemic and beyond; and to ensure risk management practices are being adhered to.’

Firms will not, Boehmer believes, be punished for seeking the financial assistance on offer during the pandemic. ‘The introduction of the furlough scheme [and] bounce-back loans were welcomed by many businesses across the UK far beyond the legal profession,’ he observes. ‘So if practices used the scheme this will not be an issue or concern for insurers. They totally understand and appreciate that this could well have been a prudent business move.’

Still, Boehmer notes, if risk and compliance staff were on furlough, that would concern insurers. The new Covid-19 forms, he adds, do not just relate to issues which have come out of nowhere: ‘It is important to add that while insurers appear to be more focused on the financial health of a practice, the reality is that many prudent insurers have been reviewing the financial position of practices for many years. Much of this work has gone unnoticed as there were previously no additional forms for practices to complete.’

Covid-19 finance may help

‘PII premiums can be a hefty up-front cost,’ the Law Society’s Davis notes, ‘and having the ability to spread payments over a longer period will help with cashflow.’ One possible source of finance, he adds, could be subsidised loans from the Coronavirus Business Interruption Loans Scheme, which provides businesses with an annual turnover of up to £45m access to loans of up to £5m, repayable over six years.

Conveyancing risk

‘Conveyancing is still insurers’ biggest concern,’ Miller’s Pickard says. ‘Perhaps even more so given Covid-19 and the impact of an economic downturn, including exposure to escalating ground rents and multiple dwelling relief applications. But wills, trust and probate [are] also now on their radar.’

‘While this is certainly not an exhaustive list,’ Boehmer says, ‘the practice areas that are most likely to impact upon an insurer’s appetite or tolerance to writing a risk will be commercial work, conveyancing and personal injury.’ Many insurers, he notes, ‘will have a cap or ceiling on the percentage of work emanating from these work disciplines’. Insurers do not, he adds, ‘tend to like practices undertaking non-legal services – especially financial services. Also, practices that are focused on financial miss-selling are incredibly difficult to place’.

Bullen-Smith highlights the prospect of claims centred on property development and investment work. ‘Solicitors who provide legal services to clients who purchase properties “off-plan” are facing increased risks of a claim,’ he notes. ‘A large deposit has normally been paid, usually in excess of 50% of the property value, and this year a number of off-plan developments have not been completed or have been seriously delayed.’

In common with others, Kennedys partner Paul Castellani identifies multiple dwellings relief as a key area for claims: ‘The major theme in the last year has been stamp duty multiple dwelling relief claims relating to alleged negligent advice concerning the reliefs available to purchasers.’ Other than that, he says, ‘claims have followed familiar causes with the majority by volume relating to conveyancing, and by severity relating to corporate or commercial litigation practice areas’.

Claims on contracts expected

Castellani identifies claims centred on contracts as a clear theme: ‘We expect to see new trends emerging such as claims relating to the manner in which contracts can be terminated because of changing commercial circumstances – such as force majeure provisions in commercial contracts, or break clauses, or options in leases.’

As businesses struggle to cope with new working patterns and a changing economy, he says ‘many will be looking to extricate themselves from contractual commitments reached in more stable economic circumstances’.

Use of technology scrutinised

With offices shut, many firms were forced to rely on staff and lawyers’ domestic technology, recognised as increasing the risk of data loss and cybercrime. ‘Insurers are looking at how firms are proactively addressing cybersecurity,’ Pickard notes.

This is linked to many items on his list of emerging claims risk themes for this year: drafting errors; cyber risks; service of notices; time limit breaches; human errors; and remote working.

‘Insurers will be more concerned with business resilience, along with the decisions that were made,’ Boehmer adds. ‘Did practices have the secure IT infrastructure to introduce remote working for their associates, allowing practices to service their clients appropriately?’

Longer policies at a premium

While a growing number of firms had found longer policies to be advantageous – typically 18 months or two years – 2020 is deemed a difficult year to obtain such deals. As Boehmer explains: ‘I would argue the positives outweigh the negatives, but in light of the prevailing market conditions the availability of these policies will be at a premium.’ The upside of longer policies, he notes, ‘is that [they provide] security for a longer period of time, meaning renewal information is less frequent and this saves practices time’. The downsides, he adds, ‘are that there could be a charge for the longer duration or they could miss positive market movements by being locked in for a longer period. But equally, on a positive note, they may be shielded from negative influences’.

Castellani weights up the pros and cons of longer policies. ‘For a firm that considers premium rates are likely to increase in 2021 and that the firm’s income (one of the main rating variables) is likely to grow, agreeing an 18- or 24-month policy which locks in premium at today’s rate is prudent,’ he says. ‘But not many firms will be anticipating fee growth this year and early indicators are that premiums will spike by up to 30% in October. Firms may also have a different risk profile in a year’s time, with changing practice areas and lower fees generated in practice areas which are historic generators of claims, such as conveyancing. Many firms may well prefer to remain nimble and agree a 12-month term.’

Still telling a story

For all that this year is different, long-standing advice on presenting a firm’s risks as well managed applies. ‘Each practice should focus on what they do as a firm to stand out from the crowd,’ Hera’s Bullen-Smith says. ‘Think about the key points that insurers are looking for and types of claims we are likely to see. Demonstrate that you understand the risks your firm creates, are implementing mitigation tools which prevent claims of this nature, and ensure you have robust risk management practices that work for your firm.’

In doing that, the Law Society’s Davis urges: ‘First and foremost, firms should already be talking with brokers about finding cover. If you have not done so, it should be made a priority now.’

- For up-to-date Law Society information on PII, click here.

2 Readers' comments