Sponsored content. Jason Coppard of Lumin Wealth highlights solutions to negate or reduce an inheritance tax (IHT) liability, in light of new rules around pensions and IHT

From 6 April 2027, unused pension funds and death benefits will form part of the estate for inheritance tax (IHT) purposes, unless they are left to a spouse or civil partner. It’s a good idea to consider your options if you have substantial assets and a large pension pot.

What are the proposed rule changes?

Under the new regime, unused pension assets – such as a self-invested personal pension, or death benefits from a defined benefit pension – will fall into the estate for IHT purposes. Pension scheme administrators will be liable for reporting and paying any IHT due on unused pension funds and death benefits. The government will provide further details in due course.

Savers with large pension pots could face a significant IHT liability

Savers who have diligently contributed to pensions and who have a handsome pot will naturally be concerned about the tax liability they now face. A married couple/civil partners could be able to benefit from a total IHT-exempt amount of up to £1,000,000. However, when factoring in total assets that fall into the estate, many families may find themselves drawn into the IHT net. The family home (beyond available allowances) rental properties/second homes, ISAs, general investment accounts and cash savings all form part of the taxable estate.

With the addition of a substantial pension(s), or pension benefits, the IHT liability for your children or other beneficiaries could be significant.

A double layer of taxation?

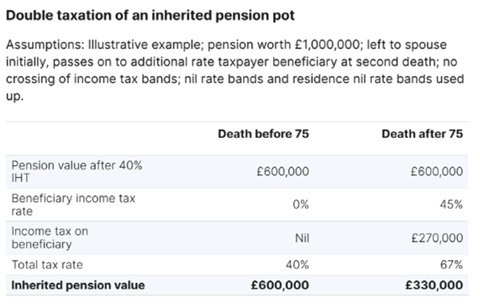

Concern has been raised regarding a potential ‘double taxation’ scenario, whereby beneficiaries could face an additional IHT charge, on top of income tax, when inheriting pension assets. Under current rules, if death occurs before age 75 there is no income tax payable when a beneficiary takes funds from an inherited pension. If death occurs after 75, the beneficiary pays income tax on any withdrawals at their marginal rate.

If an IHT charge was layered on top of income tax on withdrawals this could decimate the value of an inherited pension. In such a scenario an additional rate taxpayer could face an effective tax rate of 67%. The rules are yet to be confirmed and revisions may be made, but the example illustrates how this might work in practice.

What mitigating actions could you consider?

Any course of action should be considered carefully, possibly with the help of a specialist, depending on your personal circumstances. Possible planning solutions may involve:

- Source of retirement income: In the past, many retirees have preferred to leave pensions untouched and use other assets that form part of the estate, such as ISAs and cash, first. With pensions set to fall into the IHT net, it may make sense to utilise pension funds earlier in retirement. Formulate a plan for generating income from your assets in the most tax-efficient manner, including how much to draw down on pensions in any given year.

- Tax-free cash: Some savers may opt to draw funds from their pension and gift the proceeds to children. 25% of a pension can be taken as a tax-free cash lump sum (and then gifted). This entitlement can’t be passed on to beneficiaries, so it may make sense to take your 25% sum sooner rather than later once you reach pension access age (currently 55, 57 from 2028). Withdrawals beyond the 25% entitlement are subject to income tax at your marginal rate.

- Gifting or insurance: Giving money away can reduce IHT liabilities if you survive the gift by seven years, or if you have regular surplus income to gift. A life insurance policy can help your beneficiaries to pay an IHT bill out of the policy proceeds.

Lumin Wealth is a leading firm of Chartered Financial Planners with five offices across London and the south east. We provide independent financial advice and discretionary fund management to over 3,500 families. For growing, managing or protecting wealth, you are in expert hands with Lumin.

London Office

4th Floor, Cornwell House

21 Clerkenwell Green

EC1R 0DX

02039 887 788

jason.coppard@luminwealth.co.uk

No comments yet