If fee inflation continues on its current trajectory, it won’t be too long before top global firms are charging clients a dollar a second for star earners. Do the corporate buyers footing the bill actually care?

‘Big Law’ equity partnership is fast becoming a licence to print money – if it isn’t already. That is one conclusion that can be drawn from a bellwether of the fees charged by leading firms in 18 countries.

It is perhaps no surprise that top US attorneys do not want to queer their pitch by getting on the wrong side of Donald Trump. The biggest American firms are on track to be charging $1 a second for star partners within a decade, as fee inflation runs rampant. If the sector is price-sensitive, there is little evidence to show it.

The beanfeast is detailed in the latest annual trends report from LexisNexis CounselLink, a data-crunching resource for corporate legal departments based on invoices submitted by external advisers.

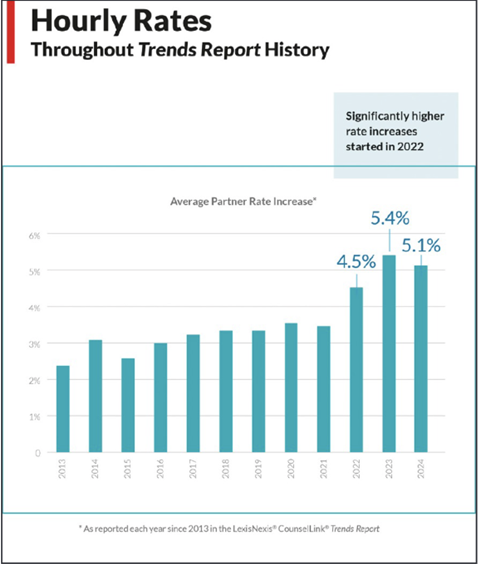

Average law firm partner rates continued to rise in 2024 at a rate of 5.1%, the second highest since CounselLink launched the report in 2013. This is only slightly down on the 5.4% rise recorded in 2023, which indicated ‘a huge spike due to the pandemic’.

Billing rates for top-ranking lawyers in high-value practices are ‘exceptionally high’. Some partners charged over $2,300 (£1,811) per hour in 2024. That is 64 cents a second. High-end associates charged nearly $2,000.

While the report focuses on partner rates as a primary benchmark, it notes that associate rates increased even more. The average partner rate increase in 2024 was 7.5% in the largest firms; the average associate rate increase was 10.8%.

On average, associate and of counsel rates have been increasing at a higher rate than partner rates for several years.

What the report calls ‘Large Law’ is here defined as firms with more than 750 lawyers. These practices continue to command a growing share of the take in the highest-value practice areas.

In 2024, as in 2023, the median partner in the largest law firms billed at a rate that was 61% higher than the median partner in the next tier of firms, confirming a wide rate gap between the top 100 firms and the next tier. The differential was 46% as recently as 2022 (relative to 2021).

2024 was the first year where the median partner rate in the largest tier of firms exceeded $1,000. For firms with 750+ lawyers, the median partner rate in 2024 was 6% higher than the previous year – well ahead of inflation.

So, which are the most profitable departments? Two perceived high-value practice areas recorded ‘exponential increases’ in median blended average matter rates in 2024: mergers and acquisitions (12.4%) and regulatory and compliance (8.3%).

‘Large law’ increased market share (from 49% in 2023 to 49.3%), but also took a higher proportion of new matter work. This suggests that the major players will continue gobbling up an ever larger slice of the pie.

For big law firms with the highest market share in the highest-value practice areas, the partner rate at the 90th percentile in 2024 was 8% higher than the partner rate at the 90th percentile in the previous year. ‘This point is significant because it says that those partners who already bill at the highest rates (very senior partners in practices such as mergers and acquisitions, regulatory and compliance, etc.) can raise their rates to an even higher degree than other partners,’ the report notes. ‘The market is bearing these rate increases.’

‘What can legal departments do about the rising chargeout rates?’, the report asks.

Several practice areas are exploring the benefits of alternative fee arrangements, but the report questions why more corporate leaders are not demanding them. ‘It seems that corporate demand for high-rate partners as outside counsel is not waning,’ LexisNexis concludes. ‘In fact, the largest law firms of 750+ lawyers continue to capitalise on that demand to maintain command of share of wallet.’

London costs expert Jim Diamond has long charted the fast-rising chargeout rates of the biggest UK firms and is a trenchant critic of real-terms fee inflation. Commenting on the LexisNexis report, Diamond said: ‘These figures reflect what has happened in the top UK law firms over the last few years – although I suspect the top rates quoted are light in terms of the “mega” US law firms.

‘The glass ceiling for inter-party hourly rates in the UK was smashed in the Mastercard case, when partner rates were claimed at £1,485 and Grade B (i.e. plus-4-year-qualified solicitor) rates claimed at £1,120.

‘The only thing that will stop these out-of-control increases in hourly rates is the development of legal AI. And common sense!’

This article is now closed for comment.

16 Readers' comments