Law firms remained financially resilient last year amid tough economic conditions - but soaring interest rates certainly helped.

These are among key findings of this year’s Law Society financial benchmarking survey, one of the sector’s most respected annual bellwethers. Some 147 firms with average turnover of £10.4m took part, making the survey one of the largest of its type in England and Wales.

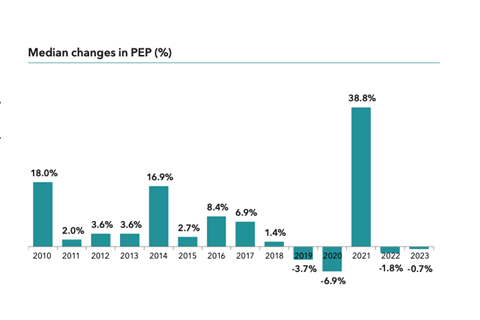

In 2022/23, median net profit per equity partner fell 0.7% on the previous year, from £211,204 to £209,650.

Last year’s survey also registered a year-on-year profit decline, of 1.8%. But the most recent two years must be viewed alongside the record near 40% increase posted in 2020/21, when many firms posted their highest PEP figures ever. Fiscal breaks, furlough cash, a red-hot housing market and a slump in overheads as staff stayed at home sent profits soaring.

The latest survey suggests many firms have managed to hang on to a substantial chunk of that ‘pandemic dividend’, in spite of higher inflation. But there is a hefty caveat. Firms were greatly aided by interest received on money held in their client accounts - a sum which climbed by 1,000% in total across the board as savings rates surged.

If interest earned is removed from from the 2022 and 2023 PEP totals, the median 2023 profit decline rises from 0.7% to 7.9%. ‘Because of uncertainties around how long the current high levels of interest will remain, we would view this as a more realistic measure of the fall in sustainable trading PEP across firms,’ the report cautions.

Declining productivity is flagged as a concern - as it was last year - but it remains unclear to what extent the hybrid working revolution is to blame.

Firms reported a median of 793 chargeable hours recorded per fee earner, compared to 816 in the previous 12 months. Junior fee-earners with no other responsibilities ‘should be looking at upwards of 1,200 or 1,300 hours’, the report says.

Looking ahead, confidence was 'fairly high' across firms in most turnover bands, with a median fee income growth prediction for 2023/24 of 3.7%.

Nick Emmerson, president of the Law Society, said: ‘Although law firms are proving to be financially strong and resilient, we live in tough economic times and this survey is an opportunity for law firm leaders to plan for the future. Despite costs rising and billable hours decreasing, profits have only marginally declined.’

Paul Bennett, chair of the Law Society’s Leadership and Management Section said: ‘The resilience of law firms shines through this year’s survey. Economically, it is a tough period, but firms are doing well. The obvious challenge of productivity shown in the reduced billed and recovered hours is a likely good place for law firm leaders to support their teams with training and personal development.’

The Financial Benchmarking Survey 2024 is written and produced by the legal team of Hazlewoods LLP for the Law Society Leadership and Management Section and sponsored by Lloyds Bank Commercial Banking.

This article is now closed for comment.

4 Readers' comments