Interest on client money turbocharged law firm profits last year, but solicitors need to 'wean themselves' off an income stream that may soon dry up.

That is a key message of this year’s Law Society Financial Benchmarking Survey, one of the sector’s most respected annual bellwethers.

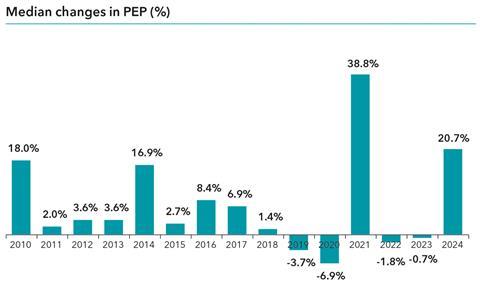

Median net profit per equity partner climbed 20.7% in 2023-24 to £249,000, the second-biggest annual rise for at least 15 years after the pandemic outlier of 2021. More than £50,000 of that surplus was contributed by client interest.

Total interest receipts soared 150% from £28m in 2023 to £69.5m, an average of nearly £500,000 per firm.

Core profitability was more modest. ‘In 2024, PEP appears to have bounced back very positively, but client interest is clouding the picture,’ the survey notes. ‘Removing client interest reveals that underlying performance has more or less flatlined, with a small rise of 1.2%.’

Despite the rise in interest income, median net profit margins fell, from 22.6% in 2023 to 22.4%.

The survey’s authors, accountancy firm Hazelwoods, warn that firms need to steel themselves for the potential loss of what has become a highly lucrative income stream since interest rates started to rise in late-2021. As part of its ongoing review of consumer protection, the Solicitors Regulation Authority appears poised to stop firms retaining interest on client cash, pending a possible switch to third-party managed accounts. This is fiercely opposed by solicitor representatives, including the Joint V coalition of the biggest regional law societies, the City of London Law Society and the national Law Society.

‘Firms have, for the last year or two, enjoyed a significant profit benefit from client account interest and the prospect of this being withdrawn ranges from the benign to the severe,’ the survey says. ‘There is the very real prospect of firms experiencing real financial stability problems without client interest and so it is important that they look to wean themselves off interest as far as possible.’

Firms have been slow to take action to mitigate this approaching squeeze, the survey suggests. In 2024 there was no ‘notable improvement’ in work in progress and debtor days, while productivity as measured by hours charged remained sluggish.

More positively, pay inflation and recruitment pressures have eased. Looking forward, market confidence is ‘fairly high’, with firms predicting median fee income growth of 4.9% in 2025, compared to the 6.1% rise reported for 2024.

Andrew Allen, partner at the law firm PKF-Francis Clark and chair of the survey working group, said: 'The survey reveals a market where profits have increased in absolute terms but the quality of those profits in many firms has deteriorated. The survey reports a growth in the median PEP in firms of nearly 21% to £249,000. However, within the 2024 results, we can report that, at the median, 22% of this PEP was interest income – in 2022 this would have been broadly 0%.'

In the upper quartile, 42% of PEP was interest income.

Allen maintained that the interest boon has been good for clients as well as practice owners, because it has held down inflation in the price of legal services. 'Overall, both consumers and law firms have benefited from the return of interest income to the financial model of law firms (the first time since pre 2008),' he added.

Abby Winkworth, chair of the Law Society Leadership and Management Section, commented: ‘The data provides both encouragement and salutary lessons. Despite market turbulence, revenues continue to grow, and wage and recruitment pressure seem to be reducing. But profit margins are vulnerable. Interest rates have helped profitability over the last couple of years, but should not be relied upon.’

Some 145 firms with average fee income of £7.8m participated in the survey, one of the largest of its type in England and Wales. It is conducted and written by the legal team of Hazlewoods for the Law Society Leadership and Management Section, and sponsored by Lloyds Bank Commercial Banking.

This article is now closed for comment.

10 Readers' comments