Law firms buoyed by interest on client money must ‘wean themselves off’ this lucrative income stream. That is a key message of the annual Law Society Financial Benchmarking Survey

Awkwardly timed it may be, but the principal finding of this year’s Law Society Financial Benchmarking Survey can hardly be airbrushed. Interest on client money turbocharged partner profits last year, while organic growth was once again conspicuous by its absence.

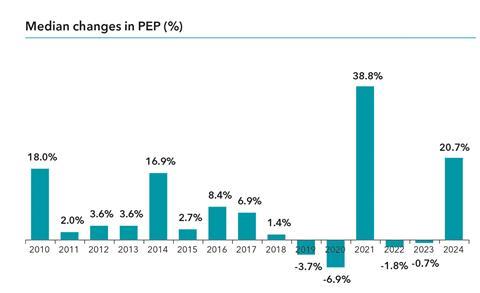

The numbers are stark. Median profit per equity partner climbed 20.7% in 2024 to £249,000, the second-biggest percentage rise for at least 15 years. The highest annual increase in that period – 39% – came in the lockdown year of 2021, which was an outlier in every sense. A crucial difference this time is that over a fifth of that PEP was pure profit generated from client interest.

‘In 2024, PEP appears to have bounced back very positively, but again client interest is clouding the picture,’ this year’s survey notes. ‘Removing client interest reveals that underlying performance has more or less flatlined, with a small rise of 1.2%.’

This boon to the bottom line looks strictly provisional, and not only because the Bank of England is once again cautiously paring interest rates. As part of its ongoing review of consumer protection, the Solicitors Regulation Authority appears minded to prevent firms from retaining any interest earned on client money pending a possible switch to third-party managed accounts. The regulator has seen ‘no compelling evidence’ that law firms profiting from client cash is in the public interest.

That is a huge red flag, as the survey is at pains to stress. Despite the rise in interest income, median net profit margins still fell last year, from 22.6% in 2023 to 22.4%.

Practitioners are advised to prepare now for the potential loss of a hefty income stream: ‘Firms have, for the last year or two, enjoyed a significant profit benefit from client account interest and the prospect of this being withdrawn ranges from the benign to the severe,’ it says. ‘There is the very real prospect of firms experiencing real financial stability problems without client interest and so it is important that they look to wean themselves off interest as far as possible.

‘Client interest should not be viewed as a necessary part of trading income and, where it is retained, we recommend that it is not used to fund short-term costs such as partner drawings or to pay operating overheads.’

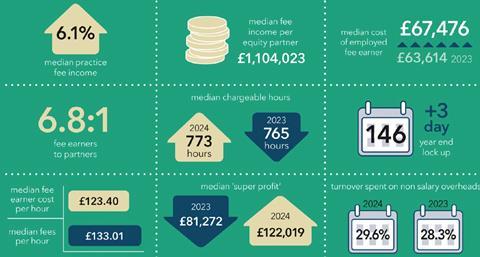

As yet there appears to be little urgency on the part of law firms to mitigate this looming earnings squeeze. In 2024 there was no ‘notable improvement’ in work in progress (WIP) and debtor days, while productivity remained sluggish. The median number of chargeable hours recorded by fee-earners in many firms remained well below the generally accepted target of 1,100 per annum, though there was a slight uptick to 773 (from 765).

‘This therefore begs the question – has client interest made firms complacent?,’ the survey asks pointedly.

Looking ahead, confidence was ‘fairly high’ across firms in most turnover bands, just as it was last year, with a median fee income growth prediction of 4.9% for 2025. Again, however, there was a marked contrast depending on the size of firm. The upper quartile predicts an increase of 11.1% and the lower quartile just 1.4%.

The Law Society said the research shows that the legal sector remains ‘resilient even in uncertain times’, noting the median 6.1% rise in fee income in 2024.

Andrew Allen, partner at law firm PKF-Francis Clark and chair of the survey working group, said: ‘The survey reveals a market where the quality of profits in many firms has deteriorated. At the median, 22% of PEP was interest income – in 2022 this would have been broadly 0%.’

Allen maintained, nevertheless, that the interest boon has been good for clients as well as practice owners, holding down inflation in the price of legal services. It has also potentially postponed a job shakeout by subsidising fee-earner capacity.

* The Financial Benchmarking Survey 2025 is written and produced by the legal team of Hazlewoods LLP for the Law Society Leadership and Management Section, and sponsored by Lloyds Bank Commercial Banking. Some 145 firms with average fee income of £7.8m participated

This article is now closed for comment.

2 Readers' comments