Tax liability. (Sponsored content.)

In 2023, the HMRC announced the implementation of reforms to the basis period method for taxation, applying to unincorporated businesses and limited liability partnerships (LLPs), with effect from 6 April 2023.

These changes come with significant cash-flow implications and affect all sole traders, unincorporated partnerships and LLPs that currently do not prepare their annual accounts to a reference date ending between 31 March and 5 April.

New basis period rules

The new legislation has changed the way trading income is allocated across tax years. From the start of the 2024/25 tax year on 6 April 2024, the basis periods of all partnerships and LLPs will be aligned to the tax year, irrespective of when the firm’s accounting reference date falls.

To transition to the new regime, HMRC has implemented various rules:

• The ‘standard’ part – the normal accounting period;plus

• The ‘transition’ part – from the end of the ‘standard’ part to 5 April 2024; less

• Overlap profits brought forward – this is the portion of profits taxed twice in these tax years

• Transitional profits – the ‘transition’ part less overlap, can be spread equally over five years starting with 2023/24 and finishing with 2027/28

The 2023/24 transition year

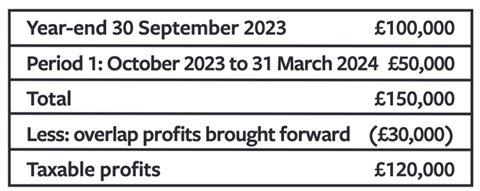

The 23/24 tax year (to 5 April 2024) was a transition year, for which the basis period was 12 months from the end of the firm’s basis period for 2022/23, plus the additional time to 5 April 2024 following the end of such period.

Relief will be given for any overlap profits generated under the current basis period rules.

Example

The changes mean that, for example, a firm which had a 30 April 2022 year-end (which would mean its profits fell to be taxed in the 22/23 tax year) would have a basis period running from 30 April 2022 to 5 April 2024. The firm will be required to apportion profits from the two different accounting periods to produce a profits figure on the tax year basis, and initially file tax returns based on provisional figures, with amendments to be made in re-filed returns the following year.

This will result in the firm’s partners being taxed on nearly two years’ profits rather than one by way of a ‘catch-up’ to the new tax-year aligned basis period.

Under the current rules, the taxable profits for the 2023/24 tax year would be £100,000 but the changes see taxable profits of £130,000 for 2023/24.

The excess profits of £20,000 can therefore be spread across five tax years, with an additional £4,000 taxable over the five years from 2023/24 to 2027/28.

Why are these changes taking place?

The aim is to simplify individuals tax affairs and the rules for allocating of trading income to particular tax years and removing the current requirements relating to double taxation of early years of trading profits.

The changes will also accelerate the speed with which income tax needs to be paid over to HMRC, therefore bringing the payment of tax closer to the point at which profits are earned.

What do law firms need to consider?

Eventualities such as partners electing not to spread the profits in the transition year should be considered, alongside any future changes to tax rates.

A key consideration will be the firm’s capital position, including the spreading across future tax years under the reforms.

Craig Reid, Sales Director at Shire Professional Funding, commented: “The basis period reform forces firms to estimate the cash-flow impact of the accelerated tax liability and find ways to mitigate any undesired scenarios. Using third-party loan facilities, where possible, is the easiest way of avoiding cash-flow issues.

As the Strategic Partner to the Law Society for finance, we can help those legal practices and professionals in need with our simple tax funding solution, tailored to their individual circumstances.”

Mallory House,

Goostrey Way,

Mobberley,

WA16 7GY

01827 300 090

No comments yet