The last time you bought something online did you read the terms and conditions? You probably did not because of something called limited attention bias – that is the technical name for such behaviour. And, of course, people looking to instruct a solicitor can display the same trait.

In theory, for important decisions like choosing a legal adviser, we should search for and read all information possible, make a reasoned judgement about the best option, and make an informed decision at the end of it. But theory is not always the reality.

Humans behave in complex and sometimes unexpected ways. We do not always read everything we are given, we have limited attention spans and make some decisions on intuition. And we do not always anticipate things that can happen in future. In behavioural research these tendencies are called biases.

These biases are important to consider in the context of the Solicitors Regulation Authority’s drive for more price and service information to be published on law firm websites. The Law Society responded to the SRA last year and made clear that its proposals might lead to consumer confusion and therefore sub-optimal decisions. We have reiterated to the SRA that its proposals should better take account of how consumers process and respond to information.

Last year, the Law Society commissioned behavioural experts London Economics and YouGov to help us identify the most useful information that solicitors could give to consumers to help them make informed decisions when searching for a lawyer. This was qualitative research, looking in detail at consumer understanding and behaviour with 75 participants.

Summary of Research Findings

- preferences can change based on the complexity of legal needs

- decisions on which legal services provider to select can change based on protections and regulation

- consumers want different things in different areas of law

- consumers don’t always read the small print

- consumers assume that all legal service providers are regulated equally

The research focused on clients of three types of relatively common legal services: conveyancing, divorce and will-writing. We noted the views and behaviours of participants in focus groups and interviews, and we also ran controlled online experiments testing responses to a range of hypothetical scenarios. By putting people in the situation of searching and selecting a legal adviser, we could better understand how people make purchasing decisions.

We gave participants a hypothetical legal issue to begin with: for example, getting a relatively simple will, with only UK-based property to be split among children. We asked participants to rank the most important things to consider when searching for a provider, and also gave them two options to choose from – a solicitor firm and a non-solicitor firm. We then introduced an unforeseen event, something that could cause harm to a consumer – for example, the will was meant to be stored but was later discovered to be lost. This process was repeated with a more complex situation, for example, a will involving overseas property or trusts.

Some of the findings look quite straightforward, while others are more surprising.

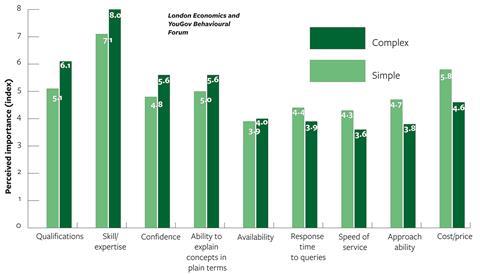

Finding: Consumers’ preferences are not fixed. At the outset of their hypothetical legal issue, many respondents indicated price was the most important factor in their choices. There was a feeling that for a simple issue, something cheap is probably good enough to get the job done. However, as they learned more about the things that could go wrong along the way – and as the issues became more complex – they increasingly valued reputation, expertise and regulatory protections (see figure 12).

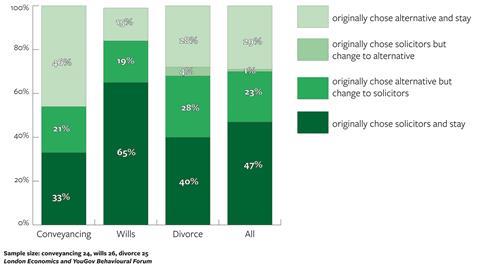

Finding: Participants also changed their decision of provider over time – many later chose a solicitor instead of an alternative provider once they became aware of the protections available from a solicitor. This was particularly noticeable for divorce customers (see graph).

Behavioural science recognises humans have limited attention, and that we often try to simplify searching by using easy rules of thumb like price to compare services. Humans also tend to underestimate the likelihood of things going wrong in future – so why would a consumer look for information on professional indemnity insurance?

There is a risk that the drive to publish more price information on websites means people make decisions mostly based on this one simplistic factor, and fail to consider other important factors. Being overly focused on price may not result in a truly informed choice. Price was also more valued when a legal problem was considered simple – and it is often not until people speak to a solicitor that they understand the full extent of their legal problems. This also shows we need to keep educating consumers about legal issues and demonstrate that solicitors provide expertise, skills, and strong client protections. If a firm does publish price information, it must be part of a broader set of information to allow a consumer to make an informed decision – and that is no easy task.

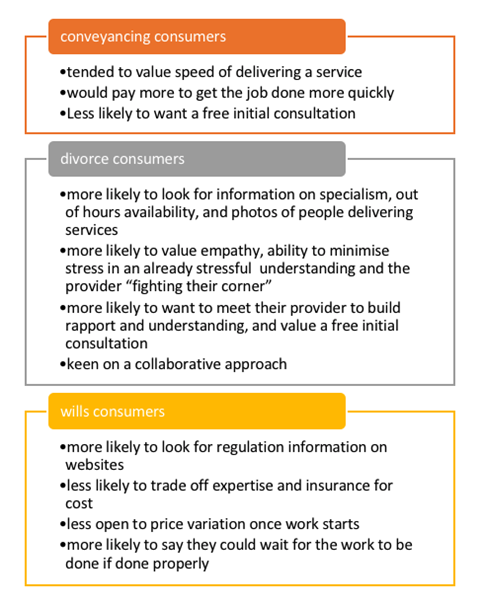

Finding: consumers have different preferences across different areas of law. (see box below). Our research only looked at three, but it is easy to see this diversity of behaviour extending to every area of practice. There is clearly no one-size-fits-all approach, so the right information will depend on the type of consumer, their preferences, and the type of legal service.

Finding: Consumers do not always read all information provided, particularly small print. Many of us would admit the same. The lesson here? Whatever information you share with your clients, try to keep things brief and focused.

Finding: participants were outraged or shocked when they found out different providers – such as solicitors, conveyancers, barristers, will-writers or others – are regulated in different ways. They valued regulation highly and assumed all legal advisers were regulated in the same way. The lesson here is that we need to ensure that clients know there are robust protections in place. It suggests trouble ahead for the SRA’s plans to allow solicitors to work in unauthorised entities – which would make a complex market even more confusing.

Behavioural research is increasingly valued by policy-makers. Last year’s Nobel Prize for Economics was awarded for behavioural economics work.

The move in 2012 to make pensions opt-out was based on work by the government’s ‘nudge unit’. Humans can be bad at planning for the future and actively deciding to save for retirement.

Automatic enrolment overcame our natural inertia and is a textbook example of applying behavioural economics to policy. The Law Society believes it is ime to apply this thinking to the legal sector too.

No comments yet