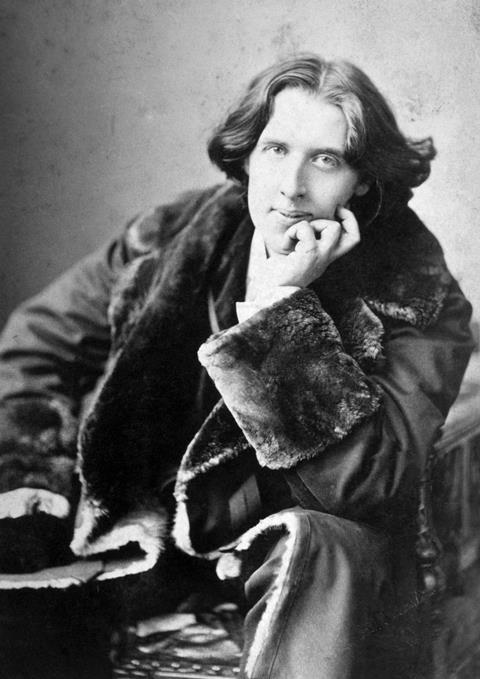

'Discontent is the first step in the progress of a man or a nation.' One need only ruminate on these words, first spoken in Oscar Wilde’s 1893 play, A Woman of No Importance, where his reflections on development, societal evolution, and progression could perhaps be transferred to the crypto sphere of today.

Discontentment with the previously patchwork regulatory and legislative tools on offer has led to an eruption of successive new developments in the digital assets space, which have sought to further place the UK centre stage, leading the charge against crypto criminality.

The past few months have treated us to a gamut of various court wins, legislative proposals, and regulatory advancements, in an effort to stem the flow of previously unchecked crypto crimes.

Take for example the announcement made by economic secretary to the treasury, Bim Afolami, in April. Afolami told the Innovate Finance Global Summit that the UK government was working to introduce new legislation to target cryptocurrencies and stablecoins by June or July of this year. The specifics of such proposed legislation are unknown, however Afolami explained that 'once it goes live, a whole host of cryptoasset activities, including operating an exchange, taking custody of customers’ assets and other things, will come within the regulatory perimeter for the first time.'

It is interesting to note that this news comes in the wake of a long line of legislative innovations seeking to bring cryptocurrencies further into the purview of third-party regulators. For instance, the enactment of the Financial Services and Markets Act 2023 has, among other things, brought cryptoassets under the scope of the definition of ‘investment’ for UK regulated activities. Moreover, the Economic Crime and Corporate Transparency Act 2023 has augmented the powers available to law enforcement in the search and seizure of cryptoassets, specifically through the amendment of criminal confiscation powers under Parts 2 to 4 of the Proceeds of Crime Act 2002, and civil recovery powers in Part 5.

Of course, this is not to say that crypto criminality is no longer a concern – a thing relegated to the past. Far from it. The extensive media coverage of the trial of ex-takeaway worker Jian Wen proves the opposite. Her conviction in March on one count of money laundering, after 61,000 bitcoins (worth approximately £3 billion in today’s value) demonstrates the magnitude of the problem.

However, the result further cements the English courts’ prowess in the fight against crypto wrongdoing. It signifies to the world that the English courts are well versed and properly rehearsed when it comes to fighting crypto money laundering on an unprecedented scale. Cryptocurrencies have long been used in the shadows, shrouded in technological sophistry, which bad actors have used to control their victims. This key case win (and others like it) attempts to demystify the tech, bolster consumer confidence, and warn crypto criminals worldwide that the UK is a haven for honest crypto users.

Nevertheless, while regulation, legislation and a strong caselaw underpinning are essential for market stability and consumer protection, balance must be struck. Where this imbalance is perhaps most notable is the UK’s treatment of crypto centric Exchange Traded Funds (ETFs).

In January, the US Securities and Exchange Commission approved 11 new spot bitcoin ETFs. ETFs are a form of security that track the value of an underlying asset (i.e. bitcoin). The ETF purchases bitcoin and issues shares that denote the bitcoins owned by the fund. The shares can then be traded on traditional stock exchanges. Market players therefore get a slice of the cryptoasset action, while negating the need to hold the underlying cryptocurrency itself. Since their approval in January, these ETFs have garnered approximately $12 billion in net inflows. To add fuel to the fire, Hong Kong launched a string of spot bitcoin and ether ETFs in April.

The UK, however, refuses to join the dance. Nevertheless, the Financial Conduct Authority announced in March that it would not object to requests from Recognised Investment Exchanges to create a UK-listed market segment for cryptoasset-backed Exchange Traded Notes (crypto ETNs), only available to professional investors. Crypto ETNs are forms of unsecured debt instruments that are linked to cryptoassets and are traded on major exchanges. The London Stock Exchange announced that it would accept applications for the admission to trading of Bitcoin and Ethereum crypto ETNs, from 8 April. Subject to the approval by the FCA of the base prospectuses, it is anticipated that these crypto ETNs will be admitted for trading from 28 May onwards.

It may not be the wholesale endorsement that crypto enthusiasts may have hoped for, but the FCA is clearly attempting to walk a delicate tightrope, adhering to its need to protect consumers from the pitfalls of this technology, while balancing legitimate market opportunities.

We can only speculate as to how these events will unfold. Continuing in this speculative vein, in a few months we may also start to see the true extent of the impact of the ‘halving’ (where the bitcoin mining reward was reduced by half from 6.25 BTC to 3.125 BTC), which took place on 19 April.

Historically, bitcoin prices have tended to rocket in the year following each previous halving event. This can be attributed to factors such as increased value perception based on scarcity of the product, or other macroeconomic influences. The last halving, for instance, took place in the wake of the start of the global pandemic in 2020, which undoubtedly led to a spike in interest for bitcoin. What’s in store for the later part of 2024 is a waiting game. Market opportunities abound and may permeate into different sectors. Wider scale crypto adoption could see an economic uptick for energy corporations supplying the power to drive the mining process forwards. The environmental consequences are however a different story. But perhaps this provides opportunity to find creative solutions to combat the crypto energy consumption conundrum for the better and for the long term.

It is, therefore, apt to heed another of Wilde’s musings: 'progress is the realisation of Utopias'. The UK has made concerted regulatory strides to demonstrate its determination to root out crypto misuses and provide a sanctuary for honest market participants. A cryptopia for a new era. We hope that the legal system will be able to keep pace with the adoption of this technology and will continue to provide a strong underpinning framework for effective cryptoasset recovery, if and when, something goes wrong. The words ‘caveat emptor’ exist in perpetuity. Crypto caveat, anyone?

Amalia Neenan FitzGerald is an associate and Keith Oliver is head of international at Peters & Peters

1 Reader's comment